Businesses of all shapes and sizes would be wise to obtain a sufficient amount of general liability insurance. It might not cover everything, but it does offer a wealth of protection for any business. There is a good chance that you’ve heard about general liability insurance. Still, you might not know how it is going to shield your Ontario business from potential problems. Within this guide, ProfessionalsCoverage will provide you with a more in-depth understanding of general liability insurance.

What does general liability insurance cover?

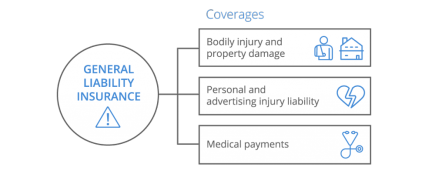

Again, general liability insurance is pretty comprehensive, but it doesn’t protect you from everything. There is also a chance that the coverages will vary slightly from one insurance policy to the next. Below, you’ll find out what is general covered.

Property Damage And Bodily Injury liability

Third parties are always at risk. You just never know when something is going to go wrong. You might have done your best, but you could have made a tiny mistake. If you did, there is a chance that a third-party is going to get injured. For instance, there is a chance that a client is going to enter your store and fall on the ground. If the floor was slick, you could be held liable for their injury. There is also a possibility that your employee is going to make a mistake and drop a hammer on the client’s foot. Again, this could lead to a lawsuit.

Just remember that general liability insurance is only designed to protect businesses from injuries to people who are not employees of said business. This insurance will also protect in the event of third-party property damage caused by your business. When mowing a client’s yard, your lawnmower could throw a stone and it could break the client’s vehicle window. In this type of scenario, the insurance will cover the costs.

Completed Operations And Products

You’ll also be happy to know that general liability insurance can shield you from risks associated with completed operations and products. Product coverage is specifically designed to protect your business when it makes, sells and distributes products. There is always a chance that your product is going to lead to a physical injury or illness. For instance, a child could choke on one of your toys. If this happens, your business will be protected by general liability insurance.

Completed operations coverage is somewhat similar. This coverage will protect your business for work that has already been completed. In order for completed operations coverage to be valid, the work needs to be completed fully. If a handyman installs a door and it winds up falling and hurting the client, this insurance will enter the picture and protect your business. The handyman’s general liability policy will cover the cost up to their liability limits.

The door needs to be completely installed and the handyman needs to leave the home, before the insurance becomes valid.

Advertising And Personal Injury

Some injuries are not physical. It is entirely possible to create problems with your advertising scheme. You might not mean to, but there is a chance that your advertising could be deemed libel or slander. It might even infringe on someone else’s copyright. For instance, a small restaurant might ridicule another local chef. That could damage the chef’s reputation and career. In return, the small restaurant may be sued.

Medical payments

Medical payments coverage provides protection to the business in the event medical or funeral insurance claims arise to clients or third parties. Example of this type of situation would be a customer coming on to your premises and getting injured due to a slipping on wet floor. Because is responsible and did not have a wet floor sign in the wet area, the business would be liability to pay. This coverage then would trigger and payout the expenses that the suffering party incurs up to the policy limit.

Damages To Rented Premises

There is a good chance that your company is going to use land and buildings that are rented. This coverage provides protection when there is damage to the rented property that is not owned by the business and the business is legally liability for the loses. Example would be, let’s say a business hosts an event at a local restaurant. One employee cause water damage to the premise by forgetting to turn off the tap in the washroom. This would be an event where coverage would apply and indemnify the restaurant, up to the policy limit.

What Isn’t covered by general liability

This type of insurance will cover a lot, but not everything. Some of the things that are not covered will be explained below.

- Employee Injuries – Workers’ compensation is needed to protect employees in the event of illness of injury while on the job site.

- Mistakes – Professional mistakes need to be protected by professional liability insurance which is also known as errors and omissions insurance.

- Commercial Automobiles – A Commercial auto insurance policy is needed to protect commercial automobiles.

- Owned Property – To protect property that your business owns, you’ll need a business owner’s policy or BOP.

How Much coverage Is Needed?

How much insurance you need depends on your exposure to risk and contractual requirements. If you face significant risks, be sure to get more coverage. Get in touch with the agents at ProfessionalsCoverage to find out what coverage your business needs. Then, we’ll help you get the coverage that you need as quickly as possible.

Want to apply for a Quote?