Bailiffs spend most of their time in court, overseeing prisoners and maintaining peace. These legal officers also must serve petitions, ensure the safety of trial participants, handle court documents and assist judges. These are big responsibilities that must be carried out five and sometimes six days a week.

Bailiffs are required to have knowledge of law enforcement and be in good physical condition, so they can do their job properly. They must also have good communication and organization skill. However, just because a bailiff meets all of these qualifications does not mean that errors cannot be made. These errors could lead to third-party personal injuries, mishandling of government information and mistrials. In these scenarios, the bailiff would probably one or more civil lawsuits.

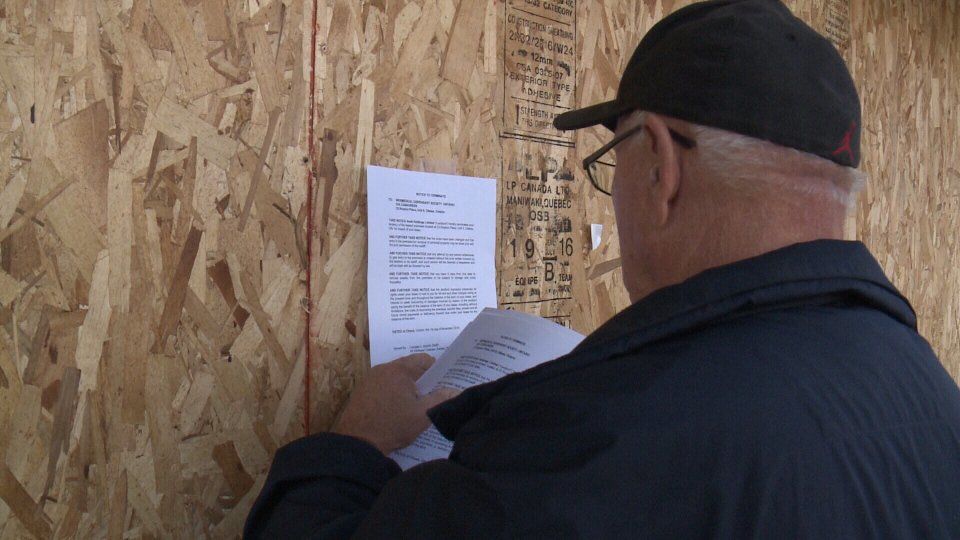

This is why all bailiffs working in Canada should carry professional liability insurance, also known as errors and omissions insurance. PLI protects against financial loss associated with negligence claims and civil lawsuits. E&O insurance may or may not cover the full cost of litigation, settlements and monetary judgments.

Obtaining professional insurance is as simple as visiting a local insurance company. Bailiffs professional liability broker offer free quotes and a broad range of insurances specifically designed to protect against financial loss related to any type of legal action. Being protected under a policy prior to beginning any legal work is the best time to be insured. Just make sure to compare professional liability insurance quotes for bailiffs with multiple insurers to get the most out of your money.

Keep in mind, if you are a business owners, your employees need to be covered if they get sick or injured while working by workers compensation coverage.

Additional Insurance Recommendations

To be fully protected from civil lawsuits, negligence claims and becoming a victim of some type of crime, it is recommended to acquire additional coverage. There are a broad range of insurances that will protect you from liabilities imposed by claims and lawsuits. If at any time you are sued for claims that are within the coverage of your insurance policies, you will not be required to pay out-of-pocket for litigation fees, settlements and monetary judgments.

Commercial General Liability Insurance

CGL, also known as general liability insurance and business liability insurance, is a must for all bailiffs working in Ontario. This insurance provides coverage for third-party injuries, property damage and civil lawsuits. It will help pay for injuries sustained by the complainant and your legal fees. Without this coverage, you could be looking at $100,000 in payouts, depending on the severity of the case.

It is recommended for bailiffs to carry at least $500,000 in coverage. However, the coverage amount will depend on your exposure and risk levels.

Commercial General Liability Insurance Recommended Limits – $500,000 per claim / $2,000,000 aggregate

Identity Theft Insurance

As a court and law official, bailiffs are at risk of identity theft. If at any time your computer or other electronic devices are breeched, your personal identifying information will be at risk. Online hackers work around the clock to obtain this information from celebrities, politicians and military and law officials. They will utilize this information to obtain loans, credit cards and public utility services. All of these expenses will be your responsibility even though you did not fill out a single loan or credit card application.

It is recommended to obtain and carry at least $100,000 in identity theft coverage. If you believe your exposures are high, you should increase your coverage amount accordingly.

Identity Theft Insurance Recommended Limits – $100,000 per claim / $1,000,000 aggregate

Possible Costs

At the end of the day, all bailiffs are going to be interested in knowing how much they’re going to be required to pay ahead of time. The costs of bailiffs PLI insurance can be expensive and the costs will climb when you combine this coverage with several others. The average costs that you could pay will be provided below for your consideration.

- Professional Liability Insurance – $60 a month

- Identity Theft Insurance – $20 a month

- Commercial General Liability Insurance – $30 a month

When it comes down to it, there are 100’s of different professions that are required to be insured before providing any services to the public. Insurance companies are aware of this and provide competitive packages to earn your business. So, you need to understand that the figures above are estimations. The prices can vary significantly based on a handful of factors. There is a good chance that you want a more precise figure. If so, you will be happy to know that you can get one within a matter of minutes. All you need to do is get in touch with our bailiffs CGL insurance company. You can contact us over the phone or by email. We’ll get back to you as quickly as possible.

Get a quote today!

Bailiff Disability Insurance

You biggest asset in life is your earning ability. If you are unable to work, you will need to rely on either your savings or borrow money to sustain your lifestyle. When these unfortunate circumstances occur, dependents and spouses are also impacted financially and emotionally.

Disability insurance coverage will provide you a monthly income benefit, usually totaling 70% to 80% of your income, when you are unable to work for a period of time due to injury or illness.

Types of disability insurance

- Long-Term Disability Insurance (LTD)

- Short-Term Disability Insurance

- Key Person Disability Insurance

- Self Employed Disability Insurance

- Mortgage Disability Insurance

- Temporary Disability Insurance

- Supplemental Disability Insurance

FAQ before purchasing bailiff professional liability insurance

- How much professional liability insurance do I need as a bailiff?

- How do I get a bailiff insurance policy?

- What does bailiff professional liability insurance cover?

- What is the difference between claims made & occurrence form of coverage?

- When will I need to be insured as a bailiff?

- What other professions need this type of insurance?

Other useful posts you should also read

- Canadian insurance companies that provide professional liability insurance for bailiffs

- How does the claims process work if I get sued because of my legal services?

- What is the cost of bailiff professional liability insurance?

- How do I apply for a bailiff professional liability insurance policy?

- How do I qualify for coverage as a bailiff?

- What is the purpose of getting insured as a bailiff?

- How long will it take to get an insurance quote for my bailiff business?